CP Global

Asset Management

We help you to navigate the future with our global macro view.

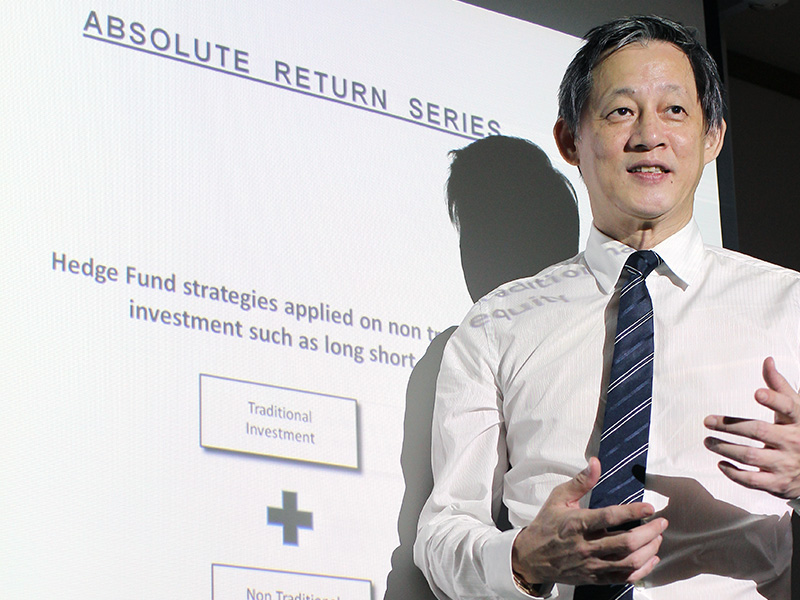

INVESTMENT PHILOSOPHY

Raymond’s investment philosophy is guided by a set of principles which is instilled throughout the firm. Be;

SIMPLICITY

DISCIPLINED

INFORMED

INNOVATIVE

RESEARCH-DRIVEN

ACTIVE MANAGEMENT

A REFLEXIVE INVESTMENT MANAGER

Raymond is guided by consistent trade strategies that focuses on capital preservation, and does not make highly-leveraged bets on the direction of the markets.

WHY CP GLOBAL?

Global Macroeconomic Analysis + Cognitive Ability + Technical Analysis Skills

Global Macro View

Our strategic and tactical investment allocation is typically based on our macro view of global economics, central banks policy, financial markets and geopolitical events. Fully aware of their dynamic development and impact to the global markets, we helps millions of investors to capitalize these opportunities and embrace the challenges from an ever-changing environment.

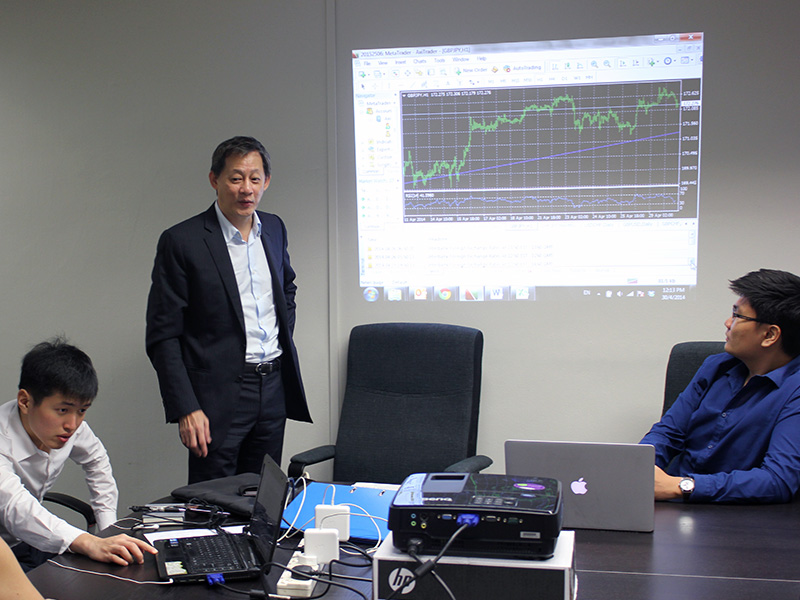

Algorithmic Technology Tools

With technology playing an increasing role in investment trading activities especially in the artificial intelligence algorithmic auto execution area, Raymond has invested a large part of his personal effort into encompassing and incorporating technology into his trading processes as an assistive tool to initiate or square off a trade.

Proven Track Record

Raymond’s trading strategy, which targets directional movements on foreign exchanges and gold prices, is based on his methodical global macroeconomic analysis, cognitive ability and technical analysis skills that have allowed the fund to consistently outperform across all asset classes for the past 20 years.

CP MULTI-STRATEGY FUND

The Fund’s investment strategy is to access and harness the performance of CPS-Master Portfolio, which is created and managed by Raymond Tan, the chief investment officer of CP Global Asset Management Limited, the Investment Manager.

CP MULTI-STRATEGY FUND

FUND STRUCTURE

The Fund is an exempted company incorporated in the Cayman Islands on 18 March 2010. The Fund is structured as an open-ended investment company with limited liability.

INVESTMENT OBJECTIVES, STRATEGY AND RESTRICTIONS

The Fund’s investment objective is to achieve medium-term capital growth by trading in a wide range of currency instruments which may include cash, futures, options, forward contract, swaps, and other derivative instruments. The Fund also invest a substantial portion of its capital in CP algorithmic trading program that developed by the Investment Manager. The Fund may hedge or protect against a potential loss of value in the portfolio’s base currency by trading in gold and other natural resources. The Fund’s investment strategy is to access and harness the performance of CPS-Master Portfolio, which is created and managed by Raymond Tan, the chief investment officer of CP Global Asset Management Limited, the Investment Manager. CPS-Master Portfolio employs multi-strategy and seeks to identify opportunities to profit from price movements and take advantage of strong market trend through managed currency trading. CP algorithmic trading program replicates and automated Alpha-Generating trader’s decision of CPS-Master Portfolio. The trading rules are trader’s rules, not mathematical constructions or Factor Models.